kentucky lottery tax calculator

25 State Tax. To estimate your tax return for 202223 please select the 2022.

Annuity Vs Lump Sum Lottery Payout Options

Each Lucky For Life play costs 2.

. 25 State Tax. Your average tax rate is 1198 and your marginal. On a 1 billion Kentucky cash ball payout youll pay 60 million to.

The calculator will display the taxes owed and the net jackpot what you take home after taxes. Kentucky Income Tax Calculator 2021. All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding.

This is still below the national average. You can enter any numeric value making it. That means that on a 20 million ticket youd pay 5 million to the.

5 Louisiana state tax on lottery winnings in the USA. Updated january 06 2018 085749theres no need to panicthere are no new figures. Jackpot size If you won a huge lottery prize enter the exact sum here.

Kentucky pales in comparison to the federal lottery tax rate which is an astounding 25 percent on all winnings over 5000. Our calculator has recently been updated to include both the latest Federal Tax. The Kentucky State Tax Calculator KYS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223.

The table below shows the payout. In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. How to Play Lucky For Life.

Kentucky Cigarette Tax. Additional tax withheld dependent on the state. Kentucky has a 6 statewide sales tax rate but also.

Lottery tax calculator takes 6. The amount of tax youll pay depends on your overall tax picture. Our Mega Millions calculator takes into account the federal and state tax rates and calculates payouts for both lump-sum cash and annual payment options so you can compare the two.

Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself at home. Choose five white balls 1 - 48 and one Lucky Ball 1 - 18 or select Quick Pick to let the computer randomly select your. Heres a quick guide on how to use our lottery tax calculator.

Current Mega Millions Jackpot. The tax rate is the same no matter what filing status you use. 5 Kentucky state tax on lottery winnings in the USA.

Tue Oct 04 080000 EDT 2022. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Usa Lottery Tax Calculators Comparethelotto Com This can range from 24 to 37 of your winnings.

Gary Kinnett of Russell Springs is seeing clearly after claiming a 50000 Powerball ticket from the games October 1st. Kentucky lottery tax calculator. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753.

This varies across states and can range from 0 to more than 8. This can range from 24 to 37 of your winnings. And you must report the entire amount you receive each year on your tax return.

Texas has chosen to add 0 additional taxes to lottery winnings. For example lets say you elected to. Kentucky imposes a flat income tax of 5.

The tax rate is the same no matter what filing status you use. The state has the choice to impose additional taxes for example if you win the lottery in New York you pay an additional. Calculate your lottery lump sum or.

That means your winnings are taxed the same as your wages or salary. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state.

Aside from state and federal taxes many Kentucky. Overview of Kentucky Taxes. Tuesday Oct 18 2022.

Our Kentucky State Tax Calculator will display a detailed graphical breakdown of the.

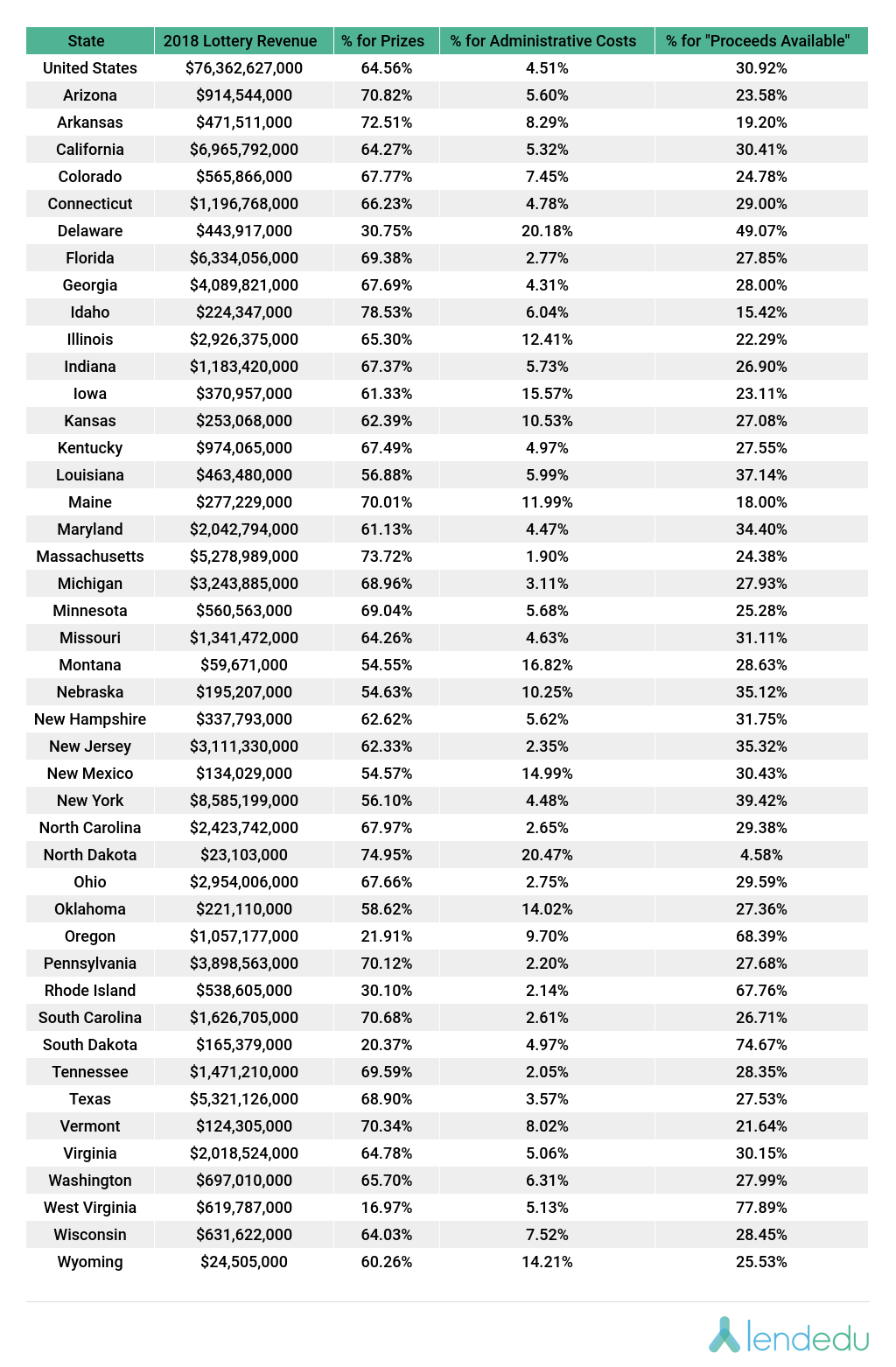

Which States Residents Spend The Most On The Lottery Lendedu

Here S How Much In Taxes You Ll Pay If You Win The 1 Billion Mega Millions And Other Fun Facts Gobankingrates

Big Win Means A Big Tax On Mega Millions 1 Billion Ticket

Top 5 Best And Worst States To Win The Lottery

Lottery Calculator The Turbotax Blog

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Lottery Tax Calculator Updated 2022 Lottery N Go

How To Calculate Florida Lottery Taxes Sapling

Do I Have To Pay State Taxes On Lottery Winnings If I Don T Live In That State

/images/2022/02/04/woman_with_lottery_ticket.jpg)

5 Tips For Avoiding Taxes On Lottery Winnings Financebuzz

Mega Millions Tax Calculator Afterlotto

Pick 4 Kentucky Ky Latest Lottery Results Game Details

Ohio Lottery Blog The Ohio Lottery

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

General Sales Taxes And Gross Receipts Taxes Urban Institute